What Does Personal Loans copyright Mean?

What Does Personal Loans copyright Mean?

Blog Article

The Ultimate Guide To Personal Loans copyright

Table of ContentsSome Known Factual Statements About Personal Loans copyright Personal Loans copyright for BeginnersMore About Personal Loans copyrightThe Personal Loans copyright Diaries7 Easy Facts About Personal Loans copyright Explained

This implies you have actually given each and every single dollar a work to do. putting you back in the driver's seat of your financeswhere you belong. Doing a normal spending plan will certainly offer you the confidence you require to handle your money efficiently. Advantages involve those who wait.Conserving up for the big points suggests you're not going into financial debt for them. And you aren't paying more over time since of all that rate of interest. Trust fund us, you'll delight in that family members cruise ship or play ground collection for the youngsters way more recognizing it's currently paid for (rather than paying on them till they're off to college).

Absolutely nothing beats peace of mind (without financial obligation of program)! You do not have to transform to personal loans and financial debt when points obtain tight. You can be free of financial debt and start making genuine grip with your money.

A personal finance is not a line of credit report, as in, it is not rotating financing. When you're approved for an individual funding, your loan provider gives you the full amount all at once and then, normally, within a month, you start settlement.

7 Easy Facts About Personal Loans copyright Shown

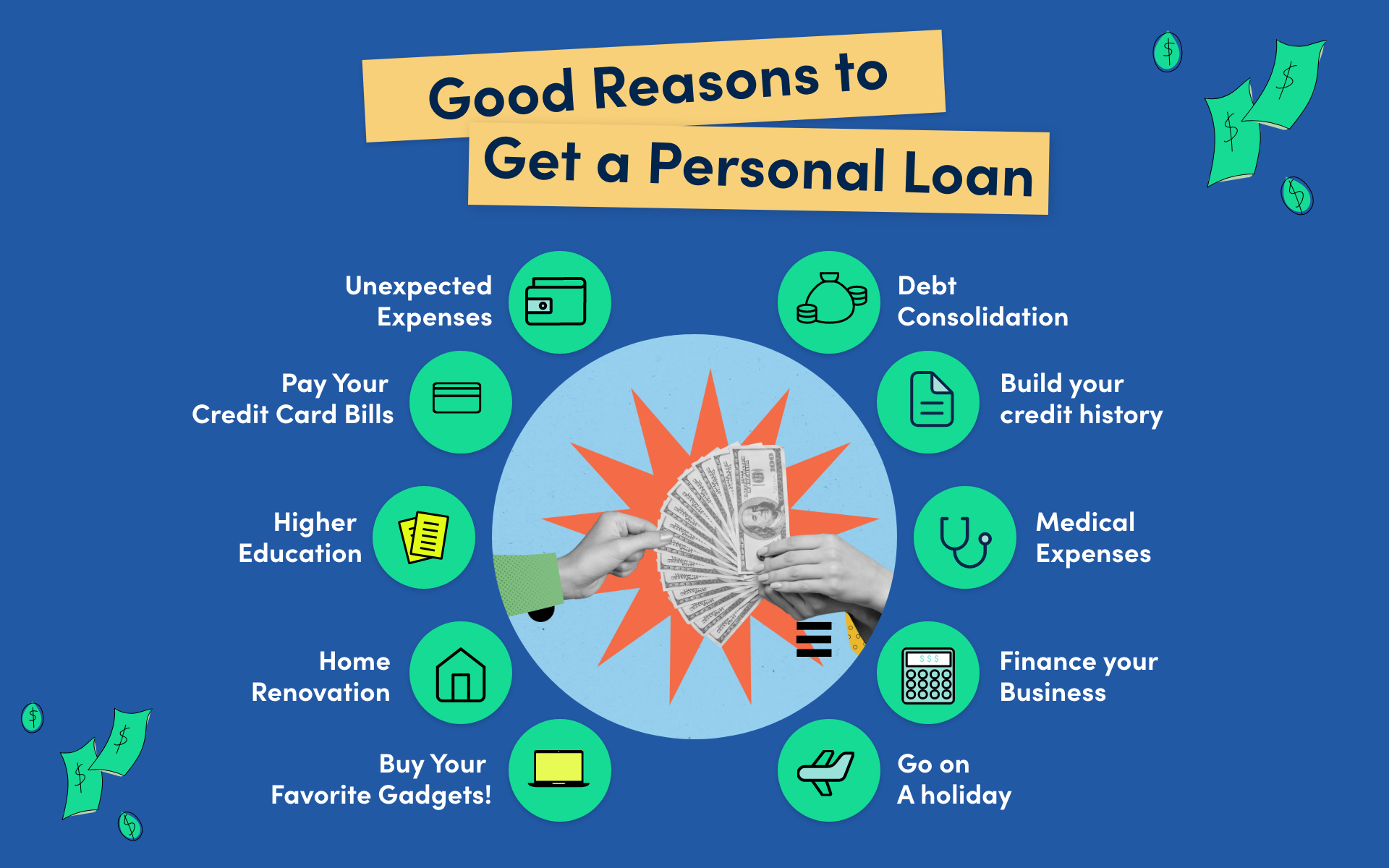

A typical reason is to consolidate and merge debt and pay all of them off at the same time with an individual loan. Some financial institutions placed stipulations on what you can use the funds for, however lots of do not (they'll still ask on the application). home enhancement loans and renovation lendings, fundings for relocating expenditures, vacation fundings, wedding financings, medical loans, automobile fixing financings, lendings for lease, tiny vehicle loan, funeral financings, or various other bill repayments generally.

The need for personal fundings is rising among Canadians interested in running away the cycle of payday financings, consolidating their financial obligation, and reconstructing their credit report score. If you're using for a personal car loan, below are some points you ought to keep in mind.

The Definitive Guide to Personal Loans copyright

Furthermore, you could be able to lower just how much total interest you pay, which suggests more money can be saved. Individual financings are effective devices for constructing up your credit report. Payment history represent 35% of your credit history, so the longer you make regular payments on schedule the more you will see your score rise.

Personal lendings provide an excellent possibility for you to rebuild your credit score and pay off financial obligation, yet if you do not spending plan correctly, you can dig yourself right into an even much deeper hole. Missing out on one of your regular monthly settlements can have a negative impact on your credit history rating but missing numerous can be ravaging.

Be prepared to make each and every single repayment on time. It's real that a personal car loan can be made use of for anything and it's much easier to get accepted than it ever before remained in the past. If you don't have an my link immediate need the added money, it might not be the best option for you.

The fixed monthly payment amount on an individual lending depends upon just how much you're borrowing, the rates of interest, and the set term. Personal Loans copyright. Your rate of interest will certainly depend on elements like your credit report and revenue. Many times, individual finance prices are a whole lot reduced than bank card, but in some cases they can be greater

Personal Loans copyright for Beginners

Perks consist of great rate of interest prices, extremely quick handling and funding times & the anonymity you may want. Not every person suches as strolling into a financial institution to ask for cash, so if this is a tough spot why not try this out for you, or you simply don't have time, looking at on the internet loan providers like Springtime is an excellent alternative.

That mainly depends on your ability to settle the quantity & benefits and drawbacks exist for both. Settlement lengths for individual lendings typically fall within 9, 12, 24, 36, 48, or 60 months. Sometimes longer payment periods are an alternative, though rare. Much shorter settlement times have extremely high monthly payments however after that it mores than swiftly and you do not shed even more money to passion.

:max_bytes(150000):strip_icc()/dotdash-070915-personal-loans-vs-car-loans-how-they-differ-v2-f8faff14abb1488d869f4026c406a86c.jpg)

Some Of Personal Loans copyright

Your rate of interest price can be tied to your repayment duration. You might get a reduced rate of interest if you finance the lending over a much shorter period. An individual term funding comes with a concurred upon repayment routine and a dealt with or floating interest price. With a drifting passion rate, the rate of interest quantity you pay will certainly fluctuate month to month based upon market modifications.

Report this page